Independent Contractor Contract Template

$89.99

Why Proper Classification Matters

This Independent Contractor Contract Template explicitly states the contractor’s non-employee status. This distinction is critical. Misclassification could result in legal and financial issues for your business. Starting with the correct classification keeps everything on track and ensures compliance with both provincial and federal laws.Focus on Business Growth

With a well-structured contract, you avoid costly disputes. Both parties can focus on achieving goals without worrying about legal complications. This template offers a simple, reliable way to protect your interests while fostering a professional relationship.Don’t take unnecessary risks. Secure your business by using our Independent Contractor Contract Template today! Currently, this product is exclusively available in English.$89.99

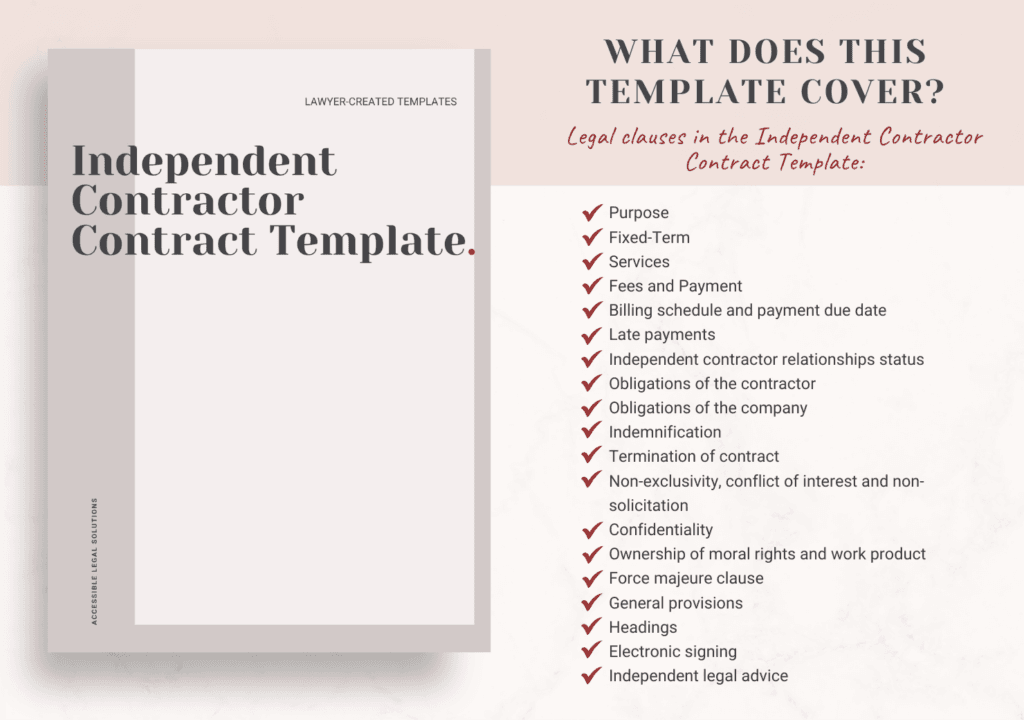

Legal clauses in this template include:

- Purpose

- Fixed-Term

- Services

- Fees and payment

- Billing schedule and payment due date

- Obligations of the contractor

- Obligations of the company

- Indemnification

- Termination of contract

- Non-exclusivity, conflict of interest and non-solicitation

- Confidentiality

- Ownership of moral rights and work product

- Force majeure clause

- General provisions

- Headings

- Electronic signing

- Independent legal advice

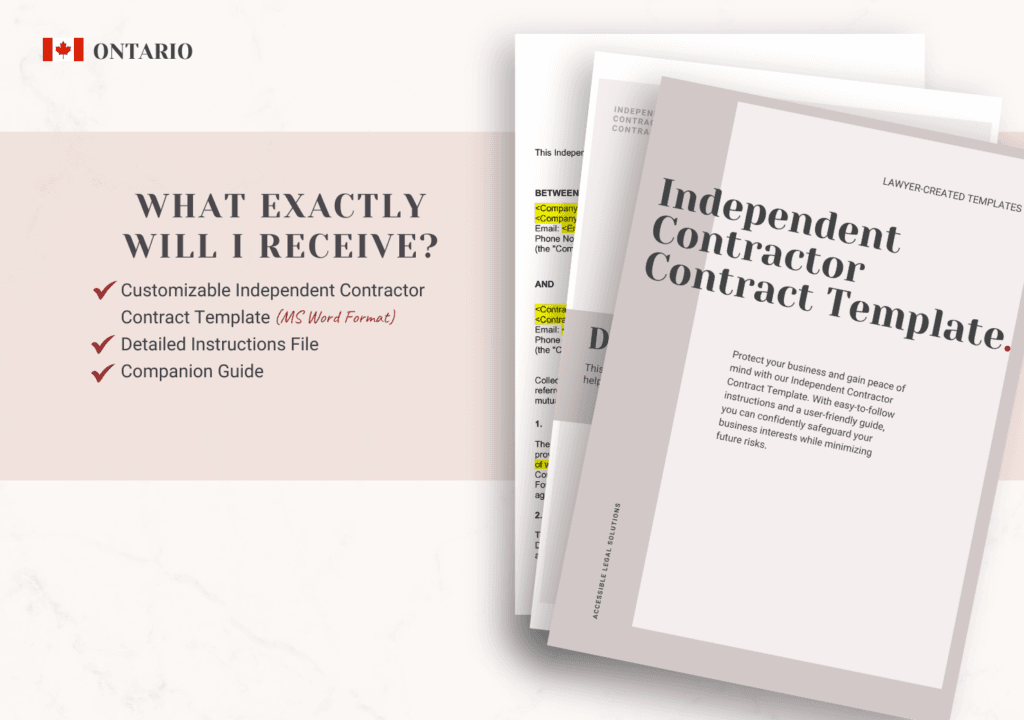

- Customizable Independent Contractor Contract Template (MS Word format)

- Detailed Instructions File

- Companion Guide

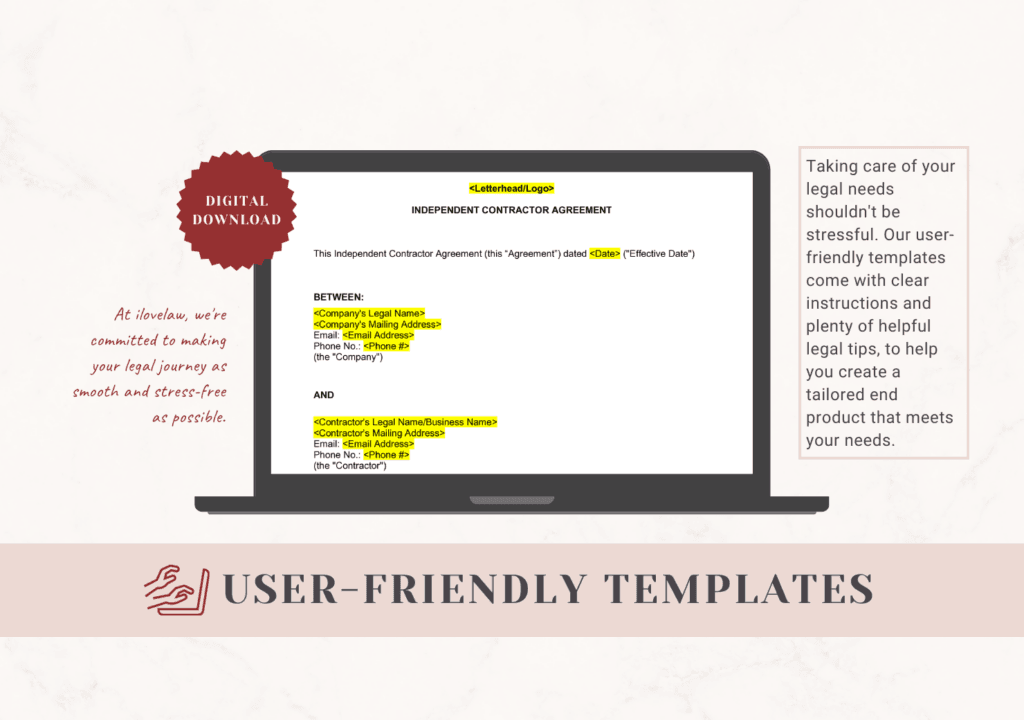

This comprehensive, customizable template is designed for Ontario business owners seeking to hire a contractor for services or contractors seeking to offer their services to a company. This contract template ensures the fair protection of both parties involved.

When to Consult a Lawyer

While this template works for many, certain situations may require a legal professional. Consider consulting a lawyer if:

- You want to modify an existing employment contract.

- Your business operates outside of Ontario.

For other hiring needs, check out:

- Employment Indefinite Contract Template: Ideal for hiring permanent fixed-term employees.

- Employment Fixed-Term Contract Template: Ideal for hiring fixed-term employees.

Unsure if This Template is Right for You?

If you’re uncertain, speak with a lawyer before moving forward. Legal advice ensures your agreement fits your business’s unique needs and circumstances. Take the time to feel confident that the document works for you.

IMPORTANT NOTE: Even with an independent contractor agreement in place, courts and the Canada Revenue Agency (CRA) may still determine that the independent contractor should have been classified as a “dependent contractor” or even an employee. This determination, however, is based on several factors. Generally, these factors include the degree of the company’s control over the work performed by the contractor, the overall nature of the work relationship, and the contractor’s economic dependence on the company. Therefore, it is important to carefully consider these aspects to ensure proper classification.

Please note: All our legal products are tailored for individuals, families and businesses located in Ontario and are subject to the laws of the province.

This product was last updated in October 2024.

Understanding the difference between an employee and an independent contractor is essential when hiring. This distinction determines working arrangements, responsibilities, and legal obligations. Let’s break it down.

What Defines an Employee?

An employee works for an employer under an employment agreement, which can be verbal or written. This agreement creates a commitment where the employee agrees to work either full-time or part-time for a set or indefinite period. In return, they receive a salary or wages.

Employers typically control how, when, and where employees perform their duties. Additionally, employees rely on the employer for tools, equipment, benefits, and tax withholdings.

What Defines an Independent Contractor?

An independent contractor, or self-employed individual, provides services to a business without becoming part of its staff. Instead, they operate under a business relationship. Contractors agree to complete specific tasks in exchange for payment. Unlike employees, they control their work process, use their tools, and cover their own benefits and taxes.

Independent contractors bear more financial risk and have greater autonomy over their work. This flexibility allows them to manage their projects independently.

Why Classification Matters

Determining whether a worker is an employee or contractor involves more than assigning a label. It’s a legal matter requiring careful assessment of key factors. Consider the level of control over the worker, ownership of tools, financial risks, and management style. These factors also influence tax obligations, compensation, and termination requirements.

Getting the classification right is crucial for compliance and avoiding legal issues. By understanding these differences, you can make informed hiring decisions and build a stronger workforce.

Virtual Witnessing Services.

Our Virtual Witnessing Services offer a convenient solution to help ensure your will and power of attorney documents are properly executed, all from the comfort of your home and without the cost or the hassle of visiting a lawyer’s office. Don’t let paperwork stand between you and peace of mind.

You Might

Also Like.

Say goodbye to hefty legal fees and hello to easy-to-use, affordable legal products.